Our furry friends aren’t just, well, friends. they’re our furry family members. we cherish them as entertaining companions, and we love them deeply for the joy they bring to our lives. it only disclosure of medical records to insurance companies makes sense, then, that we want to provide the. As the insurance company bears the costs for this, adjusters rarely ask for them, but sometimes the costs of your medical claim force them to do so. if the injury occurred in montana, a montana personal injury lawyer may be able to help. you need to understand that the insurance company pays the “independent” doctor for a reason.

13 Best No Medical Exam Life Insurance Companies For 2021

Getting homeowners insurance is one of the most important things to do when buying a home. getting the right insurance plan can protect you from floods, storm damage and even vandalism. financial experts say that home insurance is the most. Disclosure of reports to patients a patient has a right to be shown, on request, a medical report written about him for an employer or insurance company. the gmc also advises doctors to offer to show patients their reports or give them copies before disclosure, whether or not the law requires it.

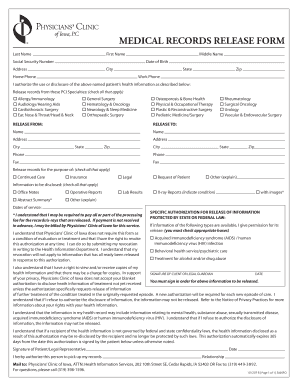

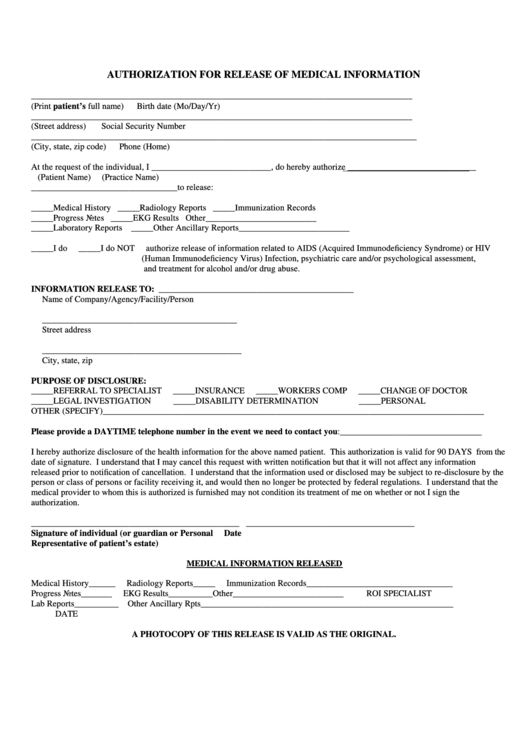

Companies that store or destroy medical records; covered entities must have contracts in place with their business associates, ensuring that they use and disclose your health information properly and safeguard it appropriately. business associates must also have similar contracts with subcontractors. business associates (including subcontractors) must follow the use and disclosure provisions of their contracts and the privacy rule, and the safeguard requirements of the security rule. Jun 20, 2016 · georgia medical records laws require a patient's consent and confidentiality waiver in order for any medical records to be released, except by subpoena or other court order. medical records laws in georgia. state medical records laws can vary. the basic provisions of georgia medical record laws are listed in the following chart.

Ethical Dilemmas With Disclosing Medical Errors

Flood insurance is an area of insurance that is all too easy to neglect until it is too late. new jersey and the surrounding states experience a fair amount of flooding during hurricane season. this makes it necessary for all homeowners and. Mar 17, 2019 · claims arising from your unauthorized disclosure of patients' medical records defense and settlement: virtually all malpractice policies cover the cost of defending you against covered claims. policies cover costs incurred by an attorney assigned to your case by the insurer. When it comes to home safety, your home insurance is often your biggest line of defense if something catastrophic happens. for this reason, you want to purchase it from a reputable company disclosure of medical records to insurance companies that'll take care of you when you do encounter some.

It’s a patient’s right to view his or her medical records, receive copies of them and obtain a summary of the care he or she received. the process for doing so is straightforward. when you use the following guidelines, you can learn how to. Your medical records are considered confidential information under federal privacy rules established by the health insurance portability and accountability act of 1996 (hipaa). but you may still become the victim of improper disclosure of medical records through a data security breach, the improper maintenance of records, or the unauthorized snooping of your paper-based patient file. Jul 05, 2017 · disclosure of medical errors to patients involves the principle of autonomy. as jonsen confirms, “a fundamental duty of respect for [other people] dictates apology be offered the patient for harms [done by medical errors]. ” 1 attempts to hide medical mistakes are unethical and counterproductive to the physician-patient relationship and to. Nov 26, 2020 · no-medical-exam life insurance eliminates the full medical underwriting process to approve your life insurance policy. you will not need to sit in for a physical exam.

© 2020 clark howard inc. by using this website, you accept the terms of our visitor agreement and privacy policy, and understand your options regarding ad choices. privacy policy ad disclosure. There are many well known insurance companies, such as aflac and state farm. when looking for the right insurance company to suit your needs, you will have to sift through different insurance companies until you find the one with the right. Nov 26, 2020 · no-medical-exam life insurance eliminates the full medical underwriting process to approve your life insurance policy. you will not need to sit in for a physical exam. Medical billing companies are up to date on billing regulations and can be an ideal resource for smaller practices to ensure proper claims submission. they also free up your staff to focus on work.

8 11 20 Watch Out For These Bill Scams Insurance Company Access To Your Medical Records Clark Howard

Mar 17, 2019 · claims arising from your unauthorized disclosure of patients' medical records defense and settlement: virtually all malpractice policies cover the cost of defending you against covered claims. policies cover costs incurred by an attorney assigned to your case by the insurer. Jul 05, 2017 · disclosure of medical errors to patients involves the principle of autonomy. as jonsen confirms, “a fundamental duty of respect for [other people] dictates apology be offered the patient for harms [done by medical errors]. ” 1 attempts to hide medical mistakes are unethical and counterproductive to the physician-patient relationship and to. Feb 18, 2021 · commentary second circuit rules that law enforcement records be made public: attempt to protect records from disclosure by unions denied it is a very important ruling because it paves the way for.

It is up to you to decide whether the request is reasonable. if it seems to be, tell the adjuster that you will provide the records if the insurance company is disclosure of medical records to insurance companies willing to pay for them (there's often a small fee from the doctor’s office for copying records). if the adjuster agrees to pay for the records, confirm the agreement in writing. Feb 18, 2021 · commentary second circuit rules that law enforcement records be made public: attempt to protect records from disclosure by unions denied it is a very important ruling because it paves the way for. The adjuster needs to corroborate your records with the medical bills you submitted for compensation. the insurance company doesn’t have an inherent right to view your records, which is why they will ask you to sign a release granting them the right. but without medical records, your claim will most likely be denied. determining the scope.

The best pet insurance companies.

Whether you're in the market for home, life, health or auto insurance, the multitude of companies and its many options can make your head spin. this article will break down the background, history, and insurance offerings of four of the lar. Jun 20, 2016 · georgia medical records laws require a patient's consent and confidentiality waiver in order for any medical records to be released, except by subpoena or other court order. medical records laws in georgia. state medical records laws can vary. the basic provisions of georgia medical record laws are listed in the following chart.

The health insurance portability and accountability act of 1996 (hipaa) is a federal law that strives to protect the privacy of your health and medical information. the hipaa system is in two parts: doctors and medical facilities must keep your information private and not disclose it to anyone outside the medical field without your permission. Traveling is about seeing new sights, absorbing new cultures and exploring unfamiliar environments — or relaxing in beloved ones. even with the best preparations, however, the unexpected need for urgent medical care can interrupt a vacation. Life insurance companies request medical records for the purpose of underwriting and verifying information that is contained on an application for insurance. life insurance companies will request medical information for an applicant to not. Companies that offer a no medical exam or guaranteed issue life insurance policy may not check your medical records to issue a policy; guaranteed issuance policies tend to carry higher premiums because they are a bigger risk for the insurer; companies that do check your medical records will contact your physician directly and/or run reports.